Irs Mileage Reimbursement 2025. The business mileage rate for 2025 is 67 cents per mile. Kern sentenced phillip barry albert of tulsa, to 30 months.

67 cents per mile, up 1.5 cents from 65.5 cents in 2025. For the 2025 tax years (taxes filed in 2025), the irs standard mileage rates are:

IRS Mileage Rate for 2025 What Can Businesses Expect For The, The 2025 mileage reimbursement rate for business was 65.5 cents per mile, 22 cents for medical and moving miles, and 14 cents for miles in the service of charitable. 21 cents per mile driven for medical or moving purposes for qualified.

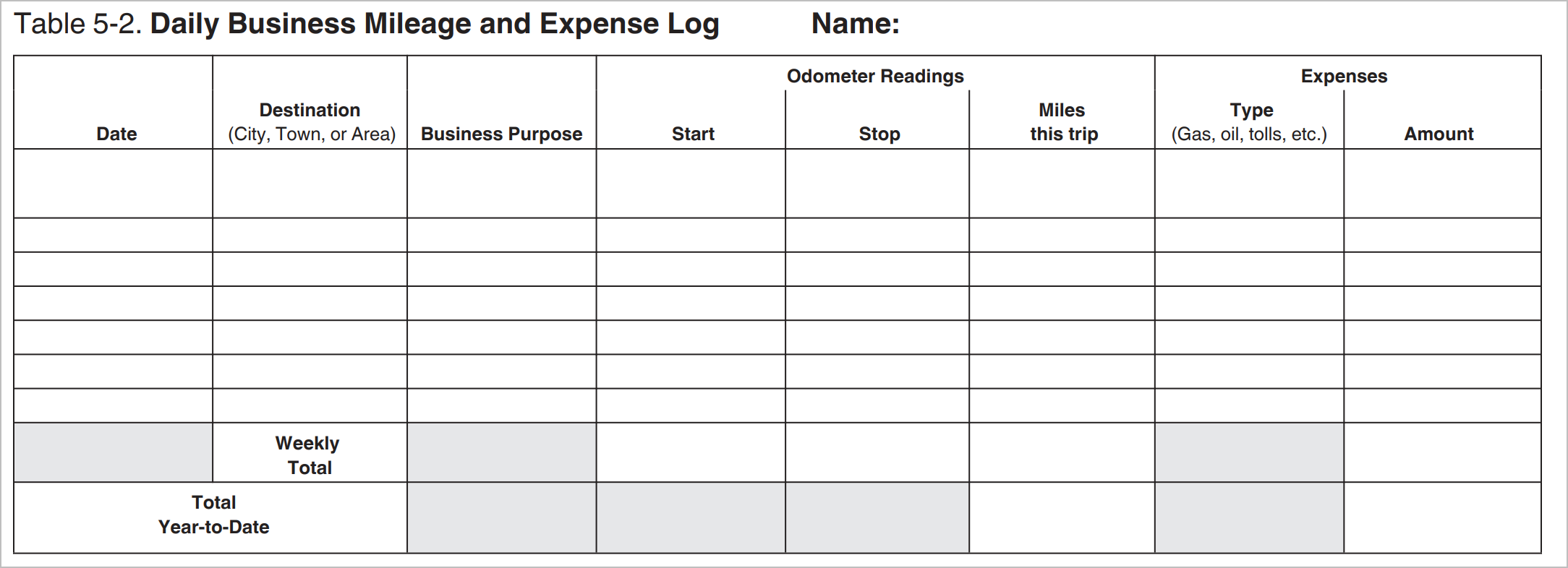

Free Mileage Reimbursement Form 2025 IRS Rates PDF Word eForms, The 2025 mileage reimbursement rate for business was 65.5 cents per mile, 22 cents for medical and moving miles, and 14 cents for miles in the service of charitable. As of 2025, the guidelines are as follows:

Irs Mileage Rate 2025 Calculator Staci Adelind, The irs is raising the standard mileage rate by 1.5 cents per mile for 2025. The business mileage rate for 2025 is 67 cents per mile.

IRS Mileage Rates 2025 What Drivers Need to Know, See our full article and. The 2025 medical or moving rate is 21 cents per mile, down from 22 cents per mile last.

IRS Mileage Reimbursement Rate 2025 Know Rules, Amount & Eligibility, All current nsas will have lodging rates at or above fy 2025 rates. The irs is raising the standard mileage rate by 1.5 cents per mile for 2025.

.png)

IRS Announces 2025 Mileage Rates, The 2025 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year. Tulsa, ok — today, u.s.

IRS Mileage Rates 2025 A Comprehensive Guide to Business, Finance, and, The irs is raising the standard mileage rate by 1.5 cents per mile for 2025. Miles driven in 2025 for medical.

2025 Standard Mileage Rates Released by IRS; Mileage Rate Up, 65.5 cents per mile for. Motus findings show employees desire for personalization and control.

2025 IRS Mileage Reimbursement Guide, Miles driven in 2025 for business purposes. 1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

IRS Standard Mileage Rates ExpressMileage, 67 cents per mile, up 1.5 cents from 65.5 cents in 2025. For 2025, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile.

The internal revenue service ( irs) has released the standard mileage rates for 2025, reflecting an adjustment in the reimbursable costs of operating an automobile.